Singapore

Corporate Tax

Review of financial statements to determine non-deductible expenses; submission of ECI, (Estimated Chargeable Income); prepare tax computation; prepare tax schedules to maximise tax exemption or minimise tax liability; submission of Income Tax Form C or CS before due date.

Our corporate taxation services starts from S$500 onwards.

Corporate Tax Singapore to maximize tax benefits.

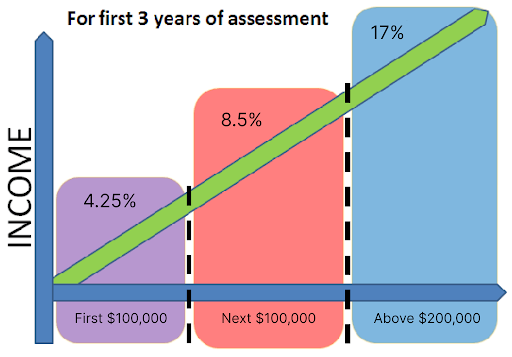

Singapore low tax rates and tax incentives continue to attract entrepreneurs around the world to setup their business companies in Singapore. The Government generous tax incentives of granting companies first 3 years of tax assessment, first $ 100,000 chargeable income (profits) at effective tax rate of 4.25% and next $ 100,000 profits at effective tax rate of 8.5% and above $ 200,000 profits, at flat 17% tax rate. Singapore has a one-tier territorial based flat-rate corporate taxation system. Tax rate is 17 percent on companies, the lowest in the world.| Year of Assessment (YA) | Exempt Amount for New Start-Up Companies | Tax Payable |

| 2020 Onwards | First $100,000 Profits at 75% Tax Free | $4,250 |

| Next $100,000 Profits at 50% Tax Free | $8,500 | |

| Total $200,000 Effective tax rate 6.375% |

4 ways you can maximise tax benefit during the first 3 years of business?

1. You should implement sales strategy that can grow the revenue.

2. You should manage direct costs, and operating expenses in a productive manner to keep cost low.

3. Singapore one-tier tax structure means that dividends paid out of retained profit, is free of tax in the hands of the shareholders.

4. Gain from disposal of fixed assets to claim as capital gain tax. There is no capital gain tax in Singapore

3 conditions must be met to qualify for tax exemption scheme for new start-up Companies

1. A private company registered in Singapore except for companies whose principal activity is that of investment holding & companies that undertaking property development for sale, investment, or both

2. In that Year of Assessment, the company is considered as Singapore tax resident.

3. Has less than 20 individual shareholders and where there is a corporate shareholder at least one shareholder holds minimum 10% of the issued ordinary shares of the company

How you can qualify for Singapore Tax Residence status?

A company is resident in Singapore for tax purposes when

- Manage and control are exercised in Singapore and

- Board meetings are held in Singapore.